How Real-Time Customer Journeys Are Rewriting Everyday Banking Experiences

Silence is where modern customer journeys break. And it’s exactly what Crédit Agricole Italia set out to fix.

Ever opened a banking app right after a big purchase and felt the silence?

No guidance. No reassurance. And, no help at the moment it mattered.

Now imagine the opposite.

You tap “pay.”

And the bank responds instantly with a helpful option.

Not a campaign. Not a pushy offer.

A service, timed perfectly.

That is the shift Crédit Agricole Italia set out to achieve—and what many CX leaders are still struggling to operationalize.

This case study explores how one of Italy’s largest banks rebuilt its customer journey architecture to move from static engagement to real-time relevance, using Adobe’s experience ecosystem as the backbone.

What Is a Real-Time Customer Journey—and Why CX Teams Need It?

A real-time customer journey adapts interactions instantly based on live customer behavior, not historical segments.

For CX leaders, this matters because customer expectations now operate in minutes, not weeks. Static journeys collapse under real-world complexity.

In banking, the cost of delay is trust.

Why Traditional CX Models Break Down in Financial Services

Banking CX teams face three structural problems.

First, data latency.

Transactional data updates slowly. Decisions lag behind reality.

Second, channel fragmentation.

Digital teams optimize apps. Branch teams optimize conversations. Journeys fracture in between.

Third, workflow silos.

Marketing, IT, compliance, and CRM operate on different timelines.

Crédit Agricole Italia faced all three.

As digital engagement increased, customer expectations shifted from “correct” to “contextual.”

The bank had data—but not velocity.

“We had strong data assets, but we couldn’t activate them fast enough to keep pace with our customers’ real lives.”

— Matteo Gianni, Head of CRM

What Problem Was Crédit Agricole Italia Really Solving?

The real challenge was not personalization. It was timing.

Customers were receiving relevant messages too late.

Mortgage promotions arrived after mortgages were signed.

Offers reflected who customers were, not what they had just done.

That gap eroded trust.

From a technology standpoint, the infrastructure was reliable—but not reactive.

“We knew where we wanted to go, but the infrastructure wasn’t built for the speed modern banking now requires.”

— Giacomo Lucchese, Head of Digital and Physical Channels

How Did Crédit Agricole Italia Build a Real-Time CX Foundation?

They unified data first, then orchestration. Not the other way around.

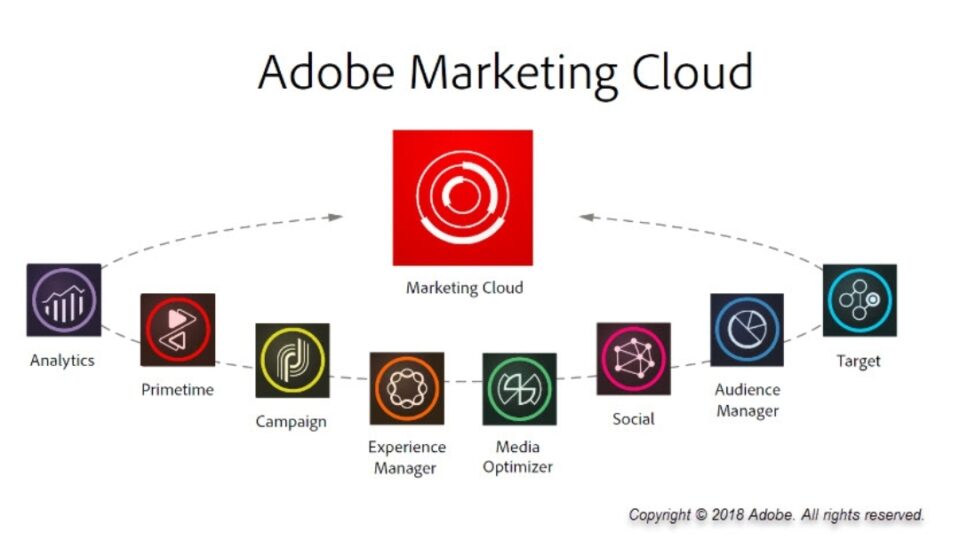

The bank established a single, scalable experience foundation using Adobe Experience Platform.

Signals flowed from across the organization:

- Transactional activity

- Digital behavior

- Product usage

- Advisor-supported interactions

All data updated continuously into one living customer profile.

Why This Step Matters for CX Leaders

Most CX failures come from trying to “orchestrate” on stale data.

Crédit Agricole Italia reversed that logic.

Instead of monthly segments, teams worked with real-time profiles powered by Adobe Real-Time CDP.

When a customer made a high-value debit transaction, the system updated immediately.

“The freshness of data is everything. In banking, relevance disappears very quickly if timing is off.”

— Lucchese

How Did Real-Time Data Change Journey Design?

Journeys shifted from campaigns to services.

With Adobe Journey Optimizer, Crédit Agricole Italia redesigned more than 150 customer journeys across acquisition, engagement, and retention.

These journeys responded automatically to customer behavior.

A Simple but Powerful Example

Before transformation:

- Customer signs a mortgage.

- Weeks later, receives a mortgage promotion.

- Experience feels disconnected.

After transformation:

- Customer completes a large debit transaction.

- Instantly receives an in-app option to split the expense into installments.

- Message arrives at the moment of financial decision-making.

That timing changed perception.

“It feels less like marketing and more like a helpful banking service.”

— Gianni

How Did Personalisation Stay Consistent Across Channels?

Continuity became the new definition of personalization.

Using Adobe Target, content adapted based on journey stage, not just demographics.

Customers saw:

- Different website banners based on recent actions

- Context-aware app experiences

- Digital conversations aligned with branch discussions

A customer starting an online account application but pausing mid-way triggered immediate follow-up guidance.

Not reminders.

Not pressure.

Help.

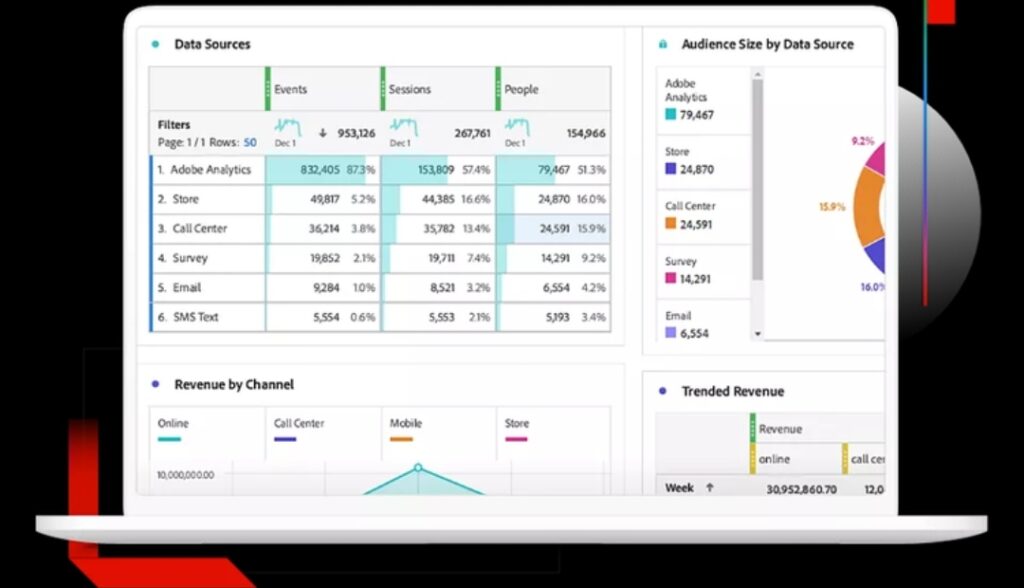

How Were Outcomes Measured Across the Full Journey?

Visibility across channels became non-negotiable.

With Adobe Customer Journey Analytics, teams tracked how customers moved between self-service and assisted interactions.

This revealed:

- Friction points

- Drop-off patterns

- Moments of high intent

Those insights drove measurable outcomes.

Business Impact Achieved

- 15% increase in first-purchase conversions

- 20% lift in cross-sell effectiveness

- 25% growth in overall engagement

- 15% reduction in churn

These gains came from relevance, not volume.

Why Internal Collaboration Was the Hidden CX Multiplier

Experience quality depends on how teams work, not just what customers see.

Crédit Agricole Italia replaced fragmented workflows with Adobe Workfront.

Marketing, IT, compliance, privacy, and communications aligned around a shared system of record.

“Adobe Workfront gave us a shared language.”

— Lucchese

Ideas moved faster.

Approvals became clearer.

Execution accelerated.

Team productivity improved by 30%.

What Role Did Partners Play in De-Risking Transformation?

Transformation at this scale rarely succeeds alone.

Crédit Agricole Italia worked with Deloitte and Adobe Professional Services for strategy, planning, and implementation.

Ongoing support from Adobe Ultimate Success helped navigate:

- Complex integrations

- Regulatory constraints

- Long-term architectural decisions

This reduced execution risk and accelerated time to value.

Common Pitfalls CX Leaders Should Avoid

Many real-time CX programs fail for predictable reasons.

- Treating real-time as a marketing feature, not an enterprise capability

- Orchestrating journeys before fixing data latency

- Ignoring compliance and governance early

- Underestimating workflow alignment

Crédit Agricole Italia addressed these upfront.

Key Insights for CX and EX Leaders

- Speed creates trust. Timing defines relevance.

- Journeys are services, not campaigns.

- Data freshness beats data volume.

- Workflow alignment enables experience excellence.

- Real-time CX requires enterprise commitment.

FAQ: Real-Time CX and Journey Orchestration

How is real-time CX different from traditional personalization?

Traditional personalization relies on historical segments. Real-time CX adapts experiences instantly based on live behavior.

Can regulated industries safely use real-time data?

Yes, with proper governance, consent management, and cross-functional alignment built into workflows.

Is real-time journey orchestration only for digital channels?

No. It enhances consistency across digital, physical, and advisor-led interactions.

How long does it take to see value?

Crédit Agricole Italia launched its first phase in under six months.

Do CX teams need to replace all legacy systems?

No. Real-time layers often sit above existing systems, activating data without full replacement.

Actionable Takeaways for CX Professionals

- Audit where journey timing breaks down today

- Identify data sources that update too slowly

- Unify profiles before redesigning journeys

- Start with one high-intent use case

- Design journeys as customer services

- Align compliance early in the process

- Measure success across channels, not silos

- Treat workflow design as CX infrastructure

Real-time journeys are not about doing more.

They are about responding better.

Crédit Agricole Italia’s transformation shows that when data, technology, and teams move together, CX stops feeling automated—and starts feeling human.

That is the real future of experience.